Article created and published by The Intelligencer CA.

Readings on inflation and inflation expectations 'could make the decision a closer call'

Two important readings come out early this week ahead of the Bank of Canada‘s interest rate decision on Jan. 25.

Earlier this month a strong jobs report tilted the odds in favour of the central bank hiking its rate by another 25 basis points to 4.5 per cent.

But December’s inflation data on Jan. 17 and the Bank’s Business Outlook Survey out Jan. 16 “could make the decision a closer call,” say RBC economists Nathan Janzen and Claire Fan.

RBC expects headline Consumer Price Index growth to slow to 6.4 per cent in December from 6.8 per cent in November. Inflation peaked at 8.1 per cent last June.

Grocery price growth, which surged 11.4 per cent year over year in November, should slow in 2023 as supply chain disruptions ease further and lower agriculture commodity prices feed through, the economists said. Moreover, gas prices fell 13 per cent in December from the month before.

The Bank of Canada’s preferred core CPI measures have slowed and the share of the price basket where inflation is above the Bank’s 1 per cent to 3 per cent target range has dropped to 60 per cent from 75 per cent during the summer, they said.

But will that be enough? Desjardins economists say that despite a likely easing of inflation in December’s data, they still see the Bank of Canada raising rates another 25 basis points later this month.

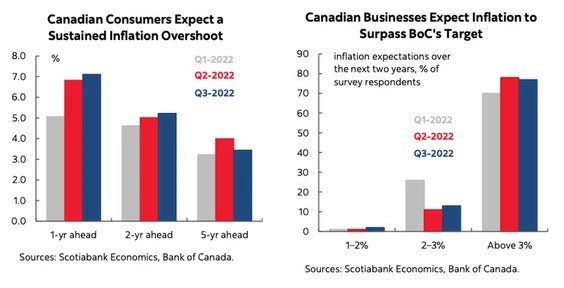

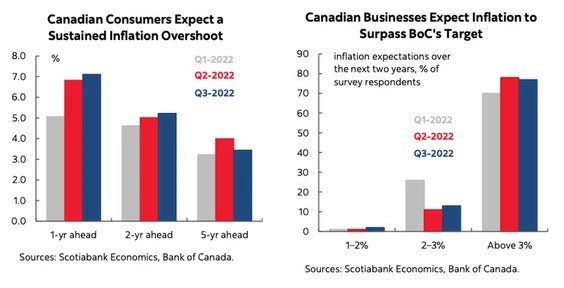

The Business Outlook Survey out Jan. 16 offers more information on two other important considerations, inflation expectations and wage plans. Earlier editions of the survey showed consumers and businesses didn’t think inflation would cool to the central bank’s target range in the medium term, said Scotiabank economist Derek Holt.